ALERT / APRIL 21, 2022 - Lovkton

It’s not too early to prepare!

The Oregon Paid Family and Medical Leave Insurance (OPFMLI) program is one of the most expansive programs in the country. Even employers with a single employee in the state must participate. Funded through payroll taxes, both employers and employees will contribute, and private plans are an option as well. This Oregon program provides broader benefits and fewer restrictions on eligibility keeping in line with the trend of states to “out-do” those with existing paid leave programs.

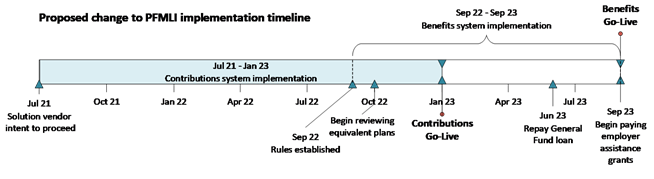

While enacted in 2019, the Oregon Employment Department (OED) extended the OPFMLI implementation timeline citing delays resulting from the COVID-19 pandemic-related recession. The present timeline set forth by the state is as follows:

With planning now well underway, detailed rules regarding the program are in development and set to be released in September. Payroll contributions begin Jan. 1, 2023, and benefit payments start Sept. 3, 2023. The OED (opens a new window) will release more information as it is available. The key details provided thus far are discussed below.

The OPFMLI applies to all employers with a single employee working anywhere in the state (excluding only the federal government and a tribal government).

Eligible employees are those with $1,000 in annual wages and low-wage earners may receive 100% wage replacement benefits ・no length of service or hours of service requirement.

The program expands the definition of family member to include any person related by blood or whose relationship is like family.

Employees eligible for paid leave benefits

Oregon employees who have contributed to the paid leave trust fund through payroll contributions (or those covered by a private plan) are eligible to apply for OPFMLI benefits after earning $1,000 in wages the year prior to seeking benefits. The wages must be earned within Oregon. If an employee performs work both within and outside the state, the service performed outside the state must be incidental to the employee’s service within the state.

Salaried, hourly, full-time, part-time and seasonal workers are covered by the OPFMLI program. Unlike other state programs, Oregon does not have a length of employment or hours of service requirement. As discussed below, job protection is predicated on 90-days of employment prior to leave. Independent contractors, self-employed individuals and tribal governments may opt in but are otherwise excluded from coverage. Federal government employees are not eligible and cannot opt in.

Oregon provides three types of leave benefits, up to 18 weeks of leave (including 4 weeks of unpaid leave), and affords employees job reinstatement

Starting Sept. 3, 2023, Oregon will require all employers in the state ・including political subdivisions of the state government ・to offer employees paid leave for up to 12 weeks (plus two additional weeks in circumstances related to pregnancy), for the following:

Medical leave for an employee’s own serious health condition

Family leave for an employee to care for and bond with their child during the first year after the child’s birth or the first year following the placement of a child through adoption or foster care, and to care for a family member with a serious health condition

Safe leave for an employee experiencing issues related to domestic violence, harassment, sexual assault or stalking as identified in ORS 659A.272 (opens a new window)

The trend among states is to use a definition of “family member” for purposes of affording employees paid leave that is far more broad than the federal definitions under laws like the Family and Medical Leave Act (FMLA). Oregon is no exception as this term includes the employee’s:

Spouse or domestic partner

Child or the child’s spouse or domestic partner

Parent or the parent’s spouse or domestic partner

Sibling or stepsibling or the sibling’s or stepsibling’s spouse or domestic partner

Grandparent or the grandparent’s spouse or domestic partner

Grandchild or the grandchild’s spouse or domestic partner

Any individual related by blood or affinity whose close association with an eligible employee is the equivalent of a family relationship

An employee can take medical, family and safe leave in any combination not to exceed 12 weeks of paid leave in a benefit year. An additional two weeks of paid leave is available to women for pregnancy, childbirth or related circumstances for a total of 14 weeks of paid leave. An employee may qualify for four additional weeks of unpaid family leave for a qualifying reason under ORS 659A.159 (opens a new window) for a maximum total of 18 weeks of leave. Notably, there is no waiting period before benefits are paid.

Lockton comment: Many states temporarily eliminated waiting periods during the pandemic to be later reinstated. Offering paid benefits without waiting periods could change employee behavior by making it more likely that they will use OPFMLI, especially when wage replacement may near 100%.

Many states only afford employees job protection through the state family and/or medical leave laws ・rather than under the paid leave program. Oregon provides job protection under both federal and state family and medical leave laws as well as under the OPFMLI program. The OPFMLI program offers employees the right to reinstatement if the employee has worked for the employer 90 days prior to the leave. If the position held by the employee at the time the leave began is not available, the employee is entitled to be restored to an available equivalent position with equivalent benefits, pay, and other terms and conditions of employment.

Employers with fewer than 25 employees have some flexibility with reinstating an employee if the position no longer exists by allowing the employee to be placed in a different position with similar job duties and pay. As in Connecticut, Oregon employers can hire temporary employees to fill in for those on a covered leave and there is no obligation to continue the temporary replacement worker’s employment once the leave period ends.

Lockton comment: While an employee with fewer than 90 days of service has no right to reinstatement, the OPFMLI does provide that it is an unlawful employment practice for an employer to deny leave or interfere with an employee’s right to leave as well as retaliate or discriminate against an employee for asking about the right to take leave. Employers should exercise caution when unable to return an employee to work following a leave not afforded job protection. Keep in mind that there may be a duty to provide leave as an accommodation under the Americans with Disabilities Act (which affords employees job protection) if the leave is for the employee’s own condition.

Employees must notify their employer of the need for leave

Similar to the FMLA, for OPFMLI benefits, employers can require employees to provide at least 30 days’ written notice of the need to take leave and must include an explanation of the need for leave. If the leave is not foreseeable, oral notice must be given within 24 hours of the start of the leave and written notice within three days after the leave begins. When unforeseeable leave is needed, oral notice can come from a person on behalf of the employee and the written notice can come from the employee’s emergency contact person or another person otherwise designated by the employee as reflected in the employer’s records.

The employee’s failure to provide timely notice may result in the reduction of the first weekly payment by up to 25% but does not otherwise impact an employee’s ability to take covered leave. It is the employer’s responsibility to notify the state if an employee fails to provide the required notice. Of note, an employee taking safe leave must provide an employer reasonable advance notice unless it is not feasible.

The amount of paid leave benefits and continued fringe benefits

While precise information is not yet available on OPFMLI paid leave amounts, the maximum weekly benefit amount is defined as 120% of the state’s average weekly wage (AWW), and the minimum weekly benefit amount is 5% ), aof the AWW. The projected benefits for 2023 are:

Minimum weekly benefit: $57

Maximum weekly benefit: $1,375

Unlike other state paid leave programs, low-wage earners in Oregon may receive 100% of their average weekly wage. An employee’s weekly benefit is calculated based on the employee’s AWW using the following formulas:

The employer's AWW is ・65% of the state’s AWW: Benefit amount is 100% of the employee's AWW

The employee’s AWW is > 65% of the state’s AWW: Benefit amount is 65% of the AWW + 50% of the employee’s AWW > 65% of the AWW

Benefits will be paid in daily or weekly increments. Leave that occurs in nonconsecutive periods can be combined when claiming benefits. Guidance on intermittent use of OPFMLI is expected in future guidance. The OED anticipates making payments within two weeks of receipt of a claim.

Employers must continue healthcare benefits during leave covered by the OPFMLI. As with other state programs, employees on paid leave cannot lose seniority or other benefits (e.g., pension) accrued prior to the date leave begins.

Coordinating paid leave with other leave benefits

Leave taken by employees for family and medical reasons runs concurrently with the Oregon Family Leave Act (OFLA) and the FMLA, as applicable.

Lockton comment: Given the job protection afforded under the OPFMLI program and the broad definition of family member, employers need to be prepared that employees may be entitled to more than 18 weeks of job-protected leave in a benefit year. For instance, an employee may take 12 weeks of leave to care for a sibling with a serious health condition. This would be covered by the OPFMLI program which would provide the employee with paid leave and job protection, but FMLA would not apply since a sibling is not a covered family member. Later that year, if the employee needs leave for their own serious health condition and the employee meets the requirements for the FMLA, the employee would be entitled to an additional 12 weeks of job-protected leave. If that leave relates to pregnancy complications, the employee may also be entitled to two weeks of additional job-protected, paid leave under the OPFMLI.

Benefits under the OPFMLI are paid in addition to any paid sick leave, vacation or other paid time off. An employer may permit an employee to use this other paid time in addition to payments under the program to replace an employee’s wages up to 100% of the employee’s AWW. Employees receiving unemployment or workers’ compensation benefits are disqualified from OPFMLI benefits.

The OPFMLI is funded through a trust fund which employees and employers will contribute to through payroll taxes. The contribution rate will be determined by the OED by November 2022 and will not exceed 1% of an employee’s wages, up to a maximum of $132,900, and will generally be shared between employer and employee contributions. The rate will be adjusted annually. Employment agencies are responsible for contributions when acting as the employer.

Employers with 25 or more employees will contribute 40% and deduct employee contributions in an amount equal to 60% of the total rate. An employer may elect to pay the required employee contributions, in whole or in part, as an employer-offered benefit.

Employers with fewer than 25 employees are not required to make the employer contributions, but if they choose to do so they may apply to receive a grant. These grants are intended to offset the costs of hiring a temporary worker or other wage-related costs. An employer may apply for up to 10 grants per calendar year.

Employers must file a combined quarterly report of wages earned and contributions paid. The report and applicable payment must be filed with the Oregon Department of Revenue on or before the last day of the month following the applicable quarter. Failure to make contributions can result in penalties with interest.

An employer that fails to file all required reports or pay all contributions due will be notified by OED on or before June 30 of each year. If prior to Sept. 1 of each year an employer has failed to file all required reports and pay all contributions due, the employer will be assessed a penalty equal to 1% of the wages of the employer’s employees in the preceding calendar year on or before Oct. 20 of each year. OED may waive the penalty for good cause if the employer has filed the required reports and payments. After a penalty is assessed, the employer has until Nov. 10 to file a written request with OED that the penalty be waived and must identify the specific reasons for the failure to file the required reports or payments by the Sept. 1 deadline.

Employees will submit claims for benefits to OED who will make the decision to allow or deny a claim within two weeks of receiving the claim. The reasons for denial will be provided. An employee may request reconsideration of the OED’s decision if there is evidence of:

Computation errors

Clerical errors

Misinformation provided to a party by the OED

Facts not previously known to the OED

Errors caused by the misapplication of the law by the OED

We anticipate the soon-to-be-released rules will identify the process through which an employer will be notified of a claim and required to verify the employee applicant’s employment.

An employer that willfully makes false statements or fails to report a material fact regarding an employee’s claim or the employee’s eligibility may be assessed a penalty up to $1,000 per occurrence. A covered individual who willfully makes false statements or fails to report material facts to obtain benefits may be disqualified from receiving benefits and penalized in an amount up to 15-30% of the benefits received. Individuals receiving benefits to which they are not entitled may be required to repay the benefits or be subject to deductions for future benefits.

Employers must provide written notice to employees regarding the OPFMLI program. A model notice will be made available to employers that satisfies this requirement. Check here (opens a new window) for updates.

Nothing in the OPFMLI requires the reopening or renegotiation of a collective bargaining agreement (CBA) entered into before the effective date of this Act on Sept. 29, 2019. A CBA may provide for greater use of family leave, medical leave or safe leave under state or federal law.

Types of equivalent plans an employer can provide

An employer may apply for approval of an employer-offered benefit plan that provides paid leave benefits in lieu of participating in the state plan. An approval process will be established. No contributions are required to be remitted to the state when employees are covered by a private plan.

Employers may file an application for a private plan beginning September 2022, which must meet the following requirements:

The plan is made available to all employees who have been continuously employed with an employer for 30 days

The benefits afforded to employees covered under the plan are equal to or greater than the weekly benefits and the duration of leave that an employee would qualify for under the OPFMLI

An employer may offer a self-funded equivalent plan and assume all financial risk associated with the bentefits and administration whether administered by the employer or a third-party administrator. An employer may also elect to offer a fully insured equivalent plan. Your Lockton account team can help you with your private plan needs.

Cost sharing is available under the private plan option

An employer may assume all or a part of the costs related to a private plan. If the employer assumes only part of the costs, the employer may deduct employee contributions in an amount that does not exceed the amount an employee would otherwise be required to contribute under OPFMLI.

An approved private plan must remain in effect for no less than one year. Employers with an approved private plan must provide notice to employees about the benefits available under the plan and other information including the process for filing a claim and how to dispute a benefit determination.

An employer must apply for reapproval of a plan once a year for three years following the date on which the state first approved the plan. No additional filing is required after three years. The equivalent plan will remain in place until withdrawn or terminated.

Claim disputes under the private plan

OED will establish a method to resolve disputes between employers and employees concerning coverage and benefits.

It’s not too early to start planning since the current guidance indicates that private plan applications can be filed in September and payroll contributions begin in January 2023. We will continue to closely follow future developments regarding this program. If you have questions, please reach out to your Lockton account team.